India's largest MF distributor NJ India Invest applies to become fund house

April 11, 2019, Contributed By: RupeeIQ

Once SEBI gives approval, NJ India, with over Rs 50,000 crore AUM, will be the first mutual fund distributor to start AMC operations

Surat's NJ India Invest, the biggest mutual fund distributor in the country in terms of commission earned, has thrown its hat in the ring to manage investor money as a mutual fund. As per Sebi, NJ India Invest, also called NJ Wealth, applied to start mutual fund business last month. The market regulator is currently studying its application.

NJ India, started by first-generation entrepreneurs Neeraj Choksi and Jignesh Desai, has over the years emerged as the number one MF distributor in terms of commissions earned, beating the likes of HDFC Bank, SBI, Axis Bank, ICICI Bank, ICICI Securities and Kotak Mahindra Bank at their own game year after year.

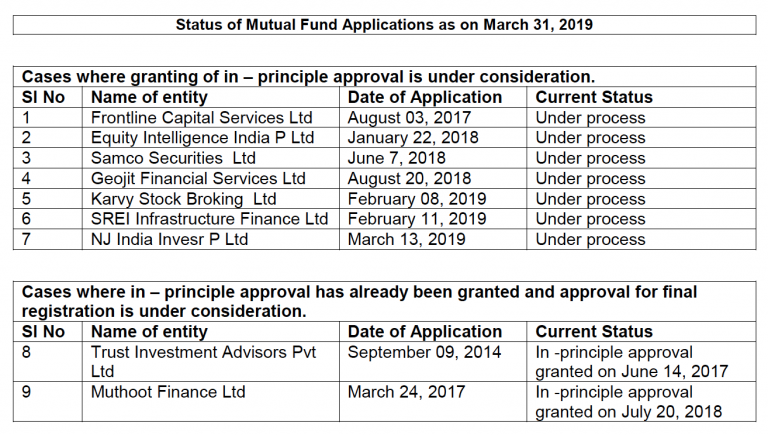

Giving the status of mutual fund applications, Sebi disclosed on its website that NJ India Invest applied for the licence on March 13, 2019. It is among the latest to apply for mutual fund licence. If approved, it will get an in-principle approval. NJ India is the seventh entity to wait for the in-principle nod from markets regulator Sebi.

A spokesperson for NJ India said the company has no comment to offer at this stage. As per AMFI data, NJ India Invest Pvt Ltd manages over Rs 50,000 crore average assets under management at the end of FY18.

Others who have applied for AMC licence are Frontline Capital Services, Equity Intelligence India (of Porinju Veliyath), Samco Securities, Geojit Financial Services (backed by Rakesh Jhunjhunwala), Hyderabad's Karvy Stock Broking, and infra financier Srei Infrastructure.

Sebi has already given an in-principle nod to Trust Investment Advisors and Muthoot Finance, and approval for final registration is under consideration.

NJ push

NJ India Invest has topped the top MF distributor list for the year 2017-18, the third year in running. Thanks to its beefed up distribution muscle, it has been among the top five for the past eight financial years ever since fund houses have been disclosing distributor commissions.

NJ AUM and commission growth

| Year | Gross MF commission & expenses paid (Rs Cr) | Year on Year growth (%) | Average Assets Under Management (Rs Cr) | Year on Year growth (%) |

| 2017-18 | 786.76 | 78 | 50156.56 | 62 |

| 2016-17 | 442.67 | 35 | 30958.92 | 29 |

| 2015-16 | 326.1 | 7 | 23943.4 | 32 |

| 2014-15 | 303.38 | 104 | 18050.14 | 51 |

| 2013-14 | 148.66 | 20 | 11928.17 | 5 |

The journey of NJ began in 1994 with the establishment of NJ India Invest Pvt. Ltd., the flagship company, to cater to investor needs in the financial services industry. Today, the NJ Wealth Distributor Network, earlier known as the NJ Fundz Network, which started in 2003, is among the largest networks of financial products distributors in India.

Over the years, NJ Group has diversified into other businesses and today has a presence in businesses ranging from financial products distributor network, asset management, real estate, insurance broking, training & development and technology. NJ Group has presence in 95+ locations in India and has over 1475+ employees.